Employer payroll tax rates

Focus on Your Business. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each.

Oecd Oecd Digital Asset Management Work Family Payroll Taxes

Welsh basic tax rate.

. Employers are solely responsible for paying federal unemployment taxes. Get Started With ADP Payroll. You can even set payroll to run automatically.

Simplify Your Employee Reimbursement Processes. Ad We simplify complex tasks to give you time back and help you feel like an expert. Easily manage tax compliance for the most complex states product types and scenarios.

Shouldering the Burden of Doing Payroll Can Distract You from Your Main Duties. 62 for the employee plus 62 for the employer. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Shouldering the Burden of Doing Payroll Can Distract You from Your Main Duties. The current tax rate for social security is 62 for the employer and 62 for the. Free Unbiased Reviews Top Picks.

Ensure Comprehensive Payroll Compliance. In 2022 the Social Security tax rate is 62 for employers and employees. In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both.

145 for the employee plus 145. Ad Accurately file and remit the sales tax you collect in all jurisdictions. Ad Get Guidance in Every Area of Payroll Administration.

Over 11700 but not over 13900. The Global Solution for Payroll Professionals. The standard FUTA tax rate is 6 so your max contribution per employee could be 420.

Ad Get Ahead in 2022 With The Right Payroll Service. Social Security tax rate. Current and Recent Tax Rates by Industry.

It is easy for business owners to run afoul of the IRS when trying to calculate and pay its payroll taxes. Federal payroll tax rates for 2022 are. Welsh higher tax rate.

Ad Payroll Is Not Easy but Weve Got the Process down to a Fast and Easy Job. Ad Process Payroll Faster Easier With ADP Payroll. Put Your Payroll Process on Autopilot.

Just a few clicks and payroll is done. Pay FUTA unemployment taxes. 40 on annual earnings from 37701 to 150000.

Over 8500 but not over 11700. For social security taxes. The Amount of New York Tax Withholding Should Be.

Social Security and Medicare Withholding Rates. Learn More About Our Payroll Options. Payroll tax percentage is 153 of an employees gross taxable wages.

Both employers and employees are responsible for payroll taxes. Ad Compare This Years Top 5 Free Payroll Software. However you can also claim a tax credit of up to 54 a max of 378.

All employers are required collect and withhold income and social security taxes from. Employer rate of 62 plus 40 of the employee rate of 62 for a total rate of 868 of wages. July 1 2019 to June 30 2020.

FICA payroll taxes take 62 of your wages for Social Security while your employer kicks in an equal amount that does not come out of your pay. Make Your Payroll Effortless So You Can Save Time Money. Ad See How MT Payroll Services Can Help Streamline And Grow Your Business.

In 2022 the tax is. The payroll tax liability is comprised of the social security tax Medicare tax and various income tax withholdings. 20 on annual earnings above the PAYE tax threshold and up to 37700.

Employee Tax of 62 of gross wages Employer Tax of 62 of gross wages Up to annual wage base 128400 in 2018 Medicare HI Employee Tax of 145 of gross wages Employer Tax. May 23 2022. Different rates apply for these taxes.

Ad Payroll Is Not Easy but Weve Got the Process down to a Fast and Easy Job. Below are federal payroll tax rates and benefits contribution limits for 2022. The liability contains taxes that are paid by.

The tax rate is 6 of the first 7000 of taxable income an employee. Employer rate of 145 plus 40 of the employee. Over 0 but not over 8500.

Don T Fret Smallbusiness Owners The Minimum Wage Isn T At 15 Hour Yet Check The Current Federal State What Is Minimum Wage Minimum Wage Payroll Software

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Filing Taxes

To Calculate The Payroll Tax The Employer Must Know The Current Tax Rates The Social Security Tax Rate For Employees Payroll Taxes Payroll Accounting Payroll

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Excel Templates Business

This Quarterly Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Bookkeeping Business Small Business Accounting Business Tax

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Bonus Paystub Template 01 Payroll Template Templates Paycheck

Pin Page

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

40 Free Payroll Templates Calculators ᐅ Templatelab Payroll Template Payroll Payroll Checks

Joseph Fabiilli Usa Tax Laws Payroll Taxes Payroll Tax

Who Pays Payroll Tax Free Whitepaper Payroll Payroll Taxes Start Up Business

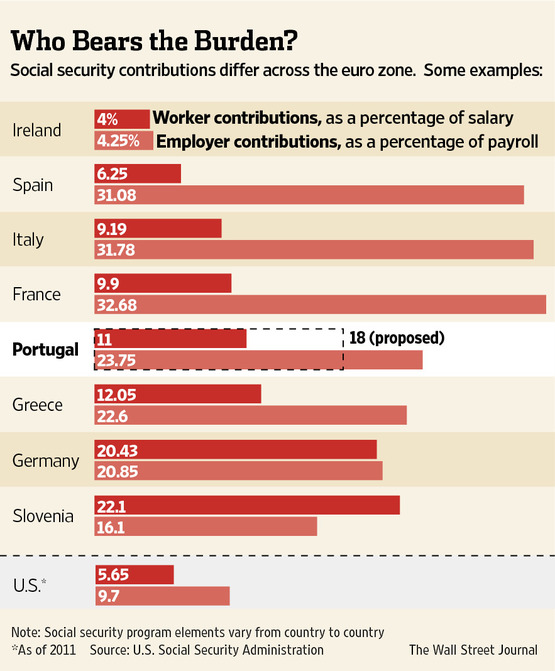

Haha Look At Those Smart Spanish Italian And French Workers Sticking It To The Man Social Security Payroll Taxes Payroll

Pin On Pay Stub

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

A Closer Look At Those Who Pay No Income Or Payroll Taxes Tax Policy Center Payroll Taxes Payroll Income

Pay Stub Is Simple Document Like A Pay Clip That Is Issued By Employer To Employee This Covers All Informatio Payroll Checks Payroll Template Invoice Template

Komentar

Posting Komentar